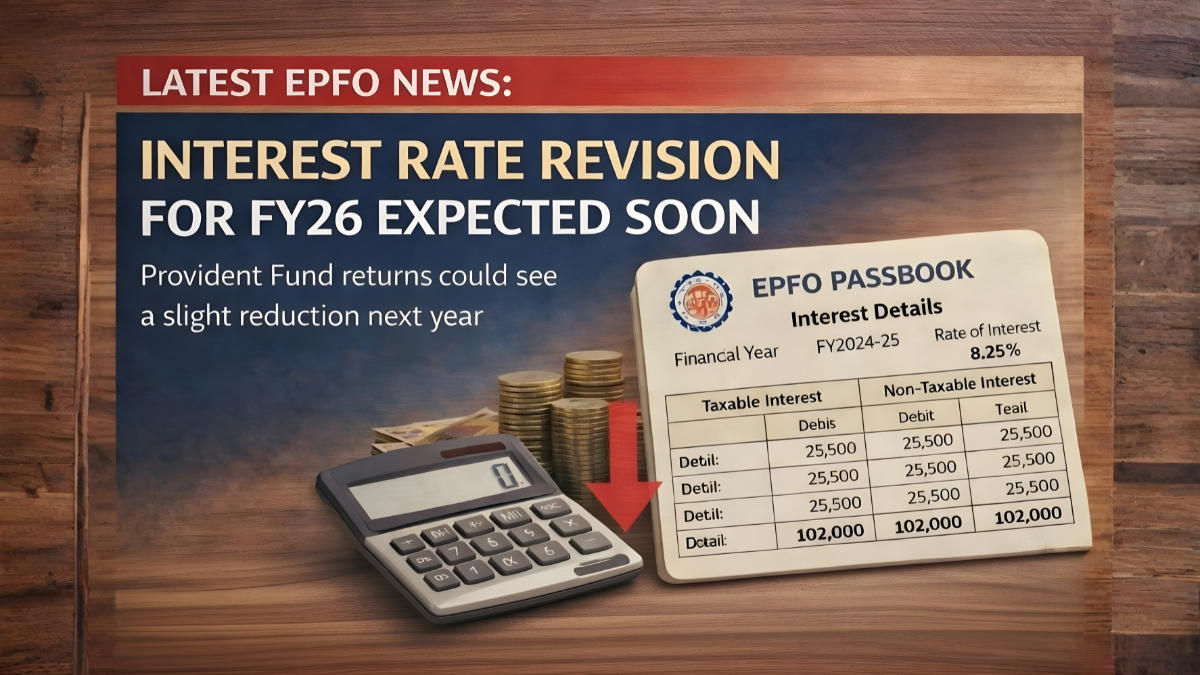

Provident Fund subscribers could see a modest revision in returns for FY26 as discussions around the EPFO interest rate indicate the possibility of a small reduction. While the cut, if implemented, is expected to be marginal, it may still influence long-term retirement planning for millions of salaried employees who rely on provident fund savings as a core financial safety net.

Why an Interest Rate Cut Is Being Discussed

The EPF interest rate is influenced by earnings from investments in bonds, government securities, and other approved instruments. Fluctuations in bond yields and broader economic conditions can affect the rate declared each year. If investment returns soften, authorities may opt for a cautious adjustment to maintain fund stability.

How It Could Affect PF Subscribers

Even a small reduction in the declared interest rate can influence the long-term growth of retirement savings. However, the impact on annual contributions may not be dramatic in the short term. The compounding nature of provident fund savings means that steady contributions over time remain the key factor in building a substantial retirement corpus.

| Category | FY26 Expectation |

|---|---|

| EPF Interest Rate | Slight downward revision under consideration |

| Coverage | Salaried employees under EPF scheme |

| Annual Credit | Interest credited at financial year-end |

| Impact Level | Marginal change in overall corpus growth |

| Decision Authority | Central board recommendation |

Role of EPFO in Rate Declaration

The final interest rate for FY26 will be recommended by the central board of trustees of the Employees’ Provident Fund Organisation and subject to government approval. The rate is typically announced after evaluating annual earnings and overall financial performance of the fund.

Should Employees Worry About the Change

A minor cut does not necessarily indicate instability. Provident Fund remains one of the safest long-term retirement savings tools in India, backed by government oversight. Subscribers are generally advised to continue regular contributions and avoid reacting to short-term fluctuations in declared rates.

Long-Term Retirement Planning Considerations

While PF offers stability and tax benefits, employees may consider diversifying retirement savings through additional instruments depending on their risk appetite. However, EPF continues to be a cornerstone of structured retirement planning for the salaried workforce.

Conclusion: The expected small cut in EPFO interest rates for FY26 may slightly reduce annual returns, but provident fund savings remain a secure and reliable retirement tool for long-term financial planning.

Disclaimer: This article is based on discussions and expectations surrounding EPFO’s interest rate decision for FY26. The final declared rate will depend on official announcements and government approval. Subscribers should refer to official EPFO communications for accurate and legally binding information regarding interest credit and policy updates.